Kingsgate Eyes 2013 Launch of Delayed Thai IPO

Kingsgate Consolidated Ltd. is continuing to work on plans for an initial public offering of its Thailand operations, with its hopes now on a possible listing from June next year.

Kingsgate Consolidated Ltd. is continuing to work on plans for an initial public offering of its Thailand operations, with its hopes now on a possible listing from June next year.

The Australian precious metals miner has been looking to list its local subsidiary, Akara Mining Ltd., on the Thai bourse for several years, but the proposal has been held up by issues including legal action by a Thai investor. Earlier this year,Kingsgate Chief Executive Gavin Thomas said the company had now decided to wait for exploration licenses near its Chatree mine in central Thailand to be granted, as this would give the listing more “sizzle” in the market.

REUTERS

“We’re still waiting for the licenses, but we are at a point where we’ll be ready to rock and roll after that,” he told Deal Journal Australia Tuesday. “We are hopeful of getting it up and running next year.”

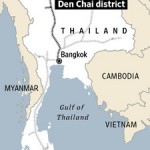

Akara has exploration prospects around its existing Chatree mine and in Thailand’s Phichit, Phitsanulok and Phetchabun provinces, north of Bangkok.

Kingsgate has been given no timetable, however, on when it will hear about its special prospecting license applications.

“Thai bureaucracy works very slowly,” Mr. Thomas said. “Still, if we can get the exploration titles later this year, or early next year, then we could be looking at an IPO from June.”

An IPO would help fund Kingsgate’s other projects, including its Bowdens silver development in New South Wales state, where the company has increased resources by 40% to 182 million troy ounces of silver equivalent, according to an announcement this week.

Construction of a mine there, though, isn’t scheduled to begin until 2015–meaning Kingsgate still has some time up its sleeve.