Meiji Yasuda buys 15percent stake in Thai Life Insurance

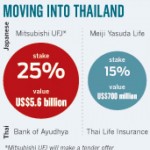

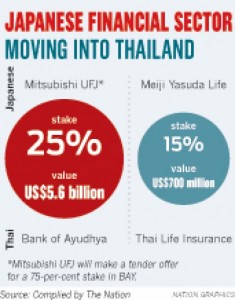

Japan’s second-largest life insurer Meiji Yasuda has become a strategic partner of Thai Life Insurance, Thailand’s third-largest, after investing about US$700 million (Bt21.8 billion) to buy a 15-per-cent stake.

Leveraging Meiji Yasuda Life’s expertise in international life insurance, product development, distribution channels and technology, the partnership is aimed at strengthening Thai Life’s efforts to tackle the ASEAN market after economic integration in a couple of years.

The management philosophy of the company will not change, Thai Life says.

Chai Chaiyawan, president of Thai Life Insurance, said Thailand would soon become part of the ASEAN Economic Community (AEC), which would fundamentally change the growth profile and competitive landscape of the insurance industry in the region. To prepare for the AEC market and to enhance Thai Life’s competitiveness, it announced yesterday that it had entered into a partnership agreement with Meiji Yasuda Life. Barclays served as sole financial adviser and Baker & McKenzie as legal adviser to Thai Life on this transaction.

“The investment in the form of a strategic partnership enables Thai Life and Meiji Yasuda Life to work closely together to achieve mutual growth by combining each party’s strengths. The strategic partnership will help Thai Life to take full advantage of the rapid growth of the economy and the life insurance industry in the ASEAN region,” he said.

“We believe Meiji Yasuda Life, being a strong international life insurance operator, will help Thai Life better serve its customers’ needs and strengthen its position as a world class life insurance company.”

As of last December 31, Thai Life had total assets of more than Bt202 billion and total reserves of Bt160 billion. In 2012, Thai Life generated first-year premiums of Bt12.4 billion, a 40-per-cent increase from 2011.

Meiji Yasuda Life is one of the largest life-insurance companies in Japan with more than 130 years of operating history. It has established a strong track record with experience in successful overseas expansion, including into the United States, China, Indonesia and Poland.

Japanese insurers have taken an interest in Thailand because of the low life-insurance penetration rate of 32 per cent. According to the Thai Life Assurance Association, the market this year is projected to grow by 17 per cent.

Big Japanese companies have been seen stepping up their movement into Southeast Asia through mergers and acquisitions (M&As) in reaction to the economic stimulus policies of Japanese Prime Minister Shinzo Abe. Japanese firms have spent $8.2 billion on M&As in Southeast Asia so far this year, far surpassing the $614 million at the same point in 2012.

Two deals helped inflate this year’s figure: Mitsubishi UFJ’s $5.6-billion bid for Bank of Ayudhya and Sumitomo Mitsui Banking Corp’s agreement to buy a 40-per-cent stake in Indonesia’s Bank Tabungan Pensiunan Nasional for about $1.5 billion.

A Thai banker said the arrival of Japanese companies would be long-term, unlike that of Chinese companies, whose government is trying to rebalance the economy for sustainable growth.

Thailand is the proper place for M&As in the view of Japanese players if their companies want to speed up investment in ASEAN ahead of the AEC, a banker said. Thailand is a springboard to other countries in the region, including southern China.

The banker said Japan’s financial sector was stepping into ASEAN as it wanted to expand its retail customer base.

From: http://www.nationmultimedia.com/business/Meiji-Yasuda-buys-15percent-stake-in-Thai-Life-Ins-30211246.html