CP All Offers $6.6 Billion for Thai Retailer Siam Makro

Billionaire Dhanin Chearavanont’s CP All (CPALL) Pcl, owner of Thailand’s 7-Eleven chain, offered to pay about $6.6 billion for discount retailer Siam Makro Pcl (MAKRO) in the biggest takeover announced in Asia this year.

CP All, controlled by Dhanin’s Charoen Pokphand Group, agreed to pay 787 baht a share for the 64 percent of Siam Makro owned by SHV Holdings NV, the company said today. It will also make a tender offer to other shareholders at the same price, a 15 percent premium to Siam Makro’s share price of 682 baht before it was suspended from trading yesterday.

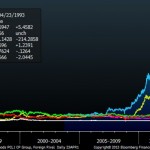

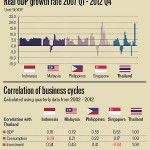

The deal is the largest on record for Thai companies, which have spent more than $31 billion on acquisitions in the past year as the baht strengthened and after their cash holdings more than quadrupled in a decade, data compiled by Bloomberg show. Dhanin alone accounts for half of that, including CP Group’s purchase of a $9.4 billion stake in China’s Ping An Insurance (Group) Co.

“Rising cash flow and the strong baht have given Thai companies some advantages,” said Adithep Vanabriksha, chief investment officer for Thailand at Aberdeen Asset Management Plc, which oversees about $7 billion of Thai assets. “We expect this trend to continue as acquisitions are a better way to utilize cash flow and take advantage of a strong currency.”

The baht has appreciated 7.6 percent, the best performance among Asia’s currencies, in the past year.

Biggest Acquisition

CP All’s acquisition of Siam Makro tops the $5.5 billion purchase of PTT Aromatics & Refining Pcl by PTT Chemical Pcl in 2011 to become the largest on record in Thailand, data compiled by Bloomberg show.

Siam Makro operates 57 Makro stores and five Siam Frozen stores. It opened five new Makro stores in 2012, helping to boost revenue by 15 percent to 112 billion baht last year, the company said on Feb. 27. The Bangkok-based company’s profit rose 37 percent to 3.56 billion baht in 2012.

Big C Supercenter Pcl (BIGC), Thailand’s second-largest hypermarket operator, surged 7.4 percent to a record 232 baht today amid speculation investors seeking retailers in the country would prefer it to CP All. CP All, which suspended trading of its shares today, slumped 6 percent yesterday.

“Some investors still wanted to stay invested in the Thai domestic consumption theme, but have soured on CP All after this deal,” said Athaporn Arayasantiparb head of research at UOB Kay Hian Securities (Thailand).

Retail Multiples

The bid values Siam Makro at about 53 times its 2012 earnings per share of 14.82 baht. That compares with a median multiple of 21 times profits paid in 22 takeovers of retailers in emerging Asia announced over the last five years, data compiled by Bloomberg show.

CP All arranged a $6 billion bridge loan from HSBC Holdings Plc, Siam Commercial Bank Pcl (SCB), Standard Chartered Plc, Sumitomo Mitsui Banking Corp. and UBS AG, according to two people familiar with the matter, who asked not to be identified because the details are private. The loan will be refinanced within a year through syndicated finance, bonds and potentially equity, the people said.

“The price we paid is not expensive,” Korsak Chairasmisak, chief executive officer of CP All, said at a media briefing in Bangkok. He said the company will use Siam Makro to expand in Southeast Asia, starting with Vietnam and Laos.

Corporate Cash

CP All and Tesco Plc (TSCO) are adding retail outlets in Thailand after the government raised minimum wages and introduced price guarantees for farmers. Demand for personal loans jumped 22 percent in 2012, the biggest increase in seven years, as Thai consumers took advantage of government incentives to buy new cars and homes.

Total cash holdings of the 421 non-financial members of the SET Index for which data is available stands at $21.4 billion, compared with about $4.4 billion in cash at the end of 2002, data compiled by Bloomberg show.

Dhanin and SHV founded Siam Makro in 1988, according to the company’s website.

Charoen Pokphand was once Siam Makro’s largest shareholder with a stake of as much as 47 percent in 1997, the same year that the devaluation of Thailand’s baht triggered a financial crisis that pushed many Asian economies into recession.

After the crisis, Dhanin sold stakes in companies including Siam Makro and Lotus Supercenter, which was bought by Tesco. In May 2005, a Charoen Pokphand unit sold 7 percent of Siam Makro back to the company that controlled the retailer for 60 baht per share.

CP All last year said it may open 7-Eleven stores in southern China and Vietnam. Dhanin earlier this month said he’s seeking more acquisitions in China.

“It’s really surprising that Siam Makro’s major shareholder decided to sell,” said Adithep from Aberdeen, who owns shares in Siam Makro and hasn’t decided whether to sell them in the tender offer. “Siam Makro is a really good company with strong earnings growth and niche market in the cash-and- carry sector.”

From: http://www.bloomberg.com/news/2013-04-23/cp-all-offers-6-6-billion-for-thai-retailer-siam-makro.html