Fueled by cheap credit, two Thai tycoons spend $27 billion on acquisitions

A flood of cheap credit is shaking the foundations of Thailand’s roaring economy. One telling sign: two Thai billionaires have spent $27 billion on mostly overseas acquisitions over the past year, more than what Thai firms overall have spent on deals in the past three years.

The shopping spree by Dhanin Chearavanont, Thailand’s richest man and owner of conglomerate CP Group, and Charoen Sirivadhanabhakdi, the “whisky tycoon” of the country’s largest beverage company, Thai Beverage, is raising concerns about the influx of hot money into one of Southeast Asia’s largest economies.

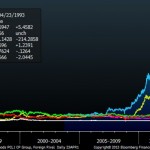

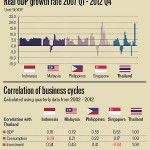

Rock-bottom interest rates and quantitative easing by central banks like the US Federal Reserve, the Bank of England and the Bank of Japan have pushed investors towards riskier assets. As a result, emerging economies like Thailand have been flooded with cash. That has driven up Bangkok’s stock market (up almost 12% this year) and its currency, and made banks more willing to lend to investors like Dhanin and Charoen.

In April, Dhanin agreed to buy discount retailer Siam Makro for $6.6 billion, funded mostly by bank loans that were pulled together within one week, according to Reuters. The Thai bank that made the loan had to get special regulatory approval to lend so much money to a single company. (The deal was financed by Siam Commercial Bank, Standard Chartered, UBS and HSBC.) A few months earlier, Dhanin had invested $9.4 billion in Chinese insurer PingAn Insurance, backed by UBS in the region’s fourth largest bridge loan. (A bridge loan is a type of interim loan common to mergers and acquisitions, which tends to be riskier than longer-term loans.)

In January, when Charoen took over Singapore’s Fraser & Neave, a food and beverage company, for $11 billion, he quadrupled ThaiBev’s debt-to-core-earnings ratio, prompting a credit downgrade (paywall) by Standard & Poor’s.

The deals are worrisome for several reasons. Some of Dhanin and Charoen’s loans are precariously tied to real estate and the stock market. Also, Thai consumer spending would need to continue growing rapidly to justify these deals, Standard Chartered analyst Nirgunan Tiruchelvam told Reuters. And that’s unlikely to happen. Thailand’s economy grew slower than expected at 5.3% in the first three months of the year, down from 19% in the previous quarter. The government also cut growth estimates for the year to between 4.2% and 5.2% (paywall) from previous forecasts of up to 5.5%.

Excessive spending and debt contributed to Thailand’s unraveling during the 1997 Asian financial crisis. To prevent a relapse, Thai regulators are working on new rules to curb the flood of foreign capital, mostly by regulating flows into Thai government bonds. As for bank lending, the Bank of Thailand has warned banks to be more judicious about home loans. But big loans to billionaires seem to be trucking along.

From: http://qz.com/92721/fueled-by-cheap-credit-two-thai-tycoons-spend-27-billion-on-acquisitions/