Thai banks ‘must think regionally’

Vichit Suraphongchai, executive chairman of Siam Commercial Bank, advises Thai banks to prepare to play the role of a regional bank.

After the Asean Economic Community (AEC) crystallises in 2015, Thai companies will expand in Asean and Thai banks including SCB must go along to pursue opportunities with their customers, he said.

SCB will build brand awareness in the region. In the areas where the bank will go, local banks should know it just like Malaysia-based CIMB or Maybank are known in Thailand.

SCB will not consider setting up its network where local banks are strong, such as Indonesia and Malaysia.

It sees a business opportunity in Laos and Myanmar.

SCB last Friday opened its representative office in Myanmar to promote trade and investment between Thailand and neighbouring countries and strengthen its business network in Mekong Sub-region countries.

“Human resources are also the bank’s focus. We should have staff that can communicate in the countries that we will go to because they might oversee our branches abroad,” he said.

Thai banks have strong capital and technology to do business in the region but the challenge for them is to learn more about each country, so SCB has given more weight to building knowledge and brand awareness locally and outside the country.

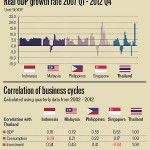

“Foreign customers looking to do business in Thailand should also know us. SCB aims to get more advantage from being a |universal bank, so the resources and structure of a universal |bank will be quickly developed,” |he said. Size is important for Thai banks to do business overseas. Four major Thai banks are large enough by assets to expand in the region, but Thai banks are not hefty enough to compare with Indonesian or Malaysian banks. SCB has to set a strategy to be selective, as foreign banks did by forming business units with expertise to capture customers.

Arthid Nanthawithaya, senior executive vice president for wholesale banking, said his group will focus more on fee income next year from investment banking, financial advisory services, foreign exchange services, trade finance and helping corporations to grow inorganically, such as by launching an initial public offering, infrastructure fund or property fund.

Fees will be 55 per cent of wholesale banking income next year and interest 45 per cent, he added.

From: http://www.nationmultimedia.com/business/Thai-banks-must-think-regionally-30195019.html