Do Asean countries offer benefits of diversification to Thai businesses?

Thai businesses are increasingly looking to expand their operations abroad over the next few years. For many, Asean countries look like attractive destinations for a number of reasons, such as good growth prospects, production factors such as labour and natural resources, cost advantages, familiarity with their business cultures, and the approaching single market under the AEC. But another aspect of overseas expansion is the advantage provided by diversification.

Thai businesses are increasingly looking to expand their operations abroad over the next few years. For many, Asean countries look like attractive destinations for a number of reasons, such as good growth prospects, production factors such as labour and natural resources, cost advantages, familiarity with their business cultures, and the approaching single market under the AEC. But another aspect of overseas expansion is the advantage provided by diversification.

What are the benefits of diversification? By operating in more than one country, multinational companies can lower the impact on their earnings from country-specific adverse events or shocks. A good example of this is provided by the great flood of 2011, which caused major disruption to manufacturing in Thailand’s central provinces, including Bangkok.

In addition to natural disasters, shocks or adverse events could come in the form of political turmoil that raises uncertainty, a tightening of monetary policy in response to inflation, or simply a shift in consumer sentiment causing a slump in demand.

From a macroeconomic point of view, multinationals can benefit from diversification if the business cycle upturns and downturns of other Asean countries are not always synchronous with those of Thailand.

How can Thai businesses diversity in Asean? The CLMV countries (Cambodia, Laos, Myanmar, and Vietnam) should offer diversification advantages because they are at different stages of development when compared to Thailand.

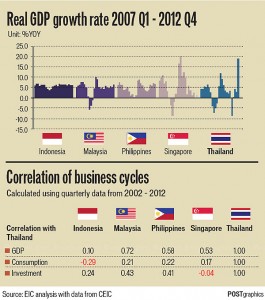

But what about countries at similar stages of development, such as Malaysia, the Philippines, Indonesia, and Singapore? Figure 1 shows that Indonesia’s GDP growth appears to be the least synchronous with Thailand’s GDP growth over the past six years. However, by looking at the plot alone, it is not possible to tell whether Malaysia is more or less synchronous with Thailand than the Philippines or Singapore.

A quick way to measure the degree of synchronisation between another country’s business cycle and Thailand’s is to look at the correlation between the real GDP growth rates of the two countries. Correlation is a value between 1.00 and -1.00, where a value close to 1.00 means business cycles of the country pair move in tandem most of the time. A value close to -1.00 means business cycles move in an opposite direction most of the time, and a value close to 0 means business cycles do not move together in any pattern. Thus, to derive benefits from diversification, Thai businesses should look for locations where the correlation is well below 1.00.

Table 1 reveals that Thai businesses could benefit most from diversification in Indonesia. The low correlation between the GDP growth rates of Indonesia and Thailand is quite attractive, as it means that Thai businesses can expect operations in Indonesia to be relatively unaffected by Thailand’s business cycle.

In contrast, Malaysia may offer little in terms of diversification as the correlation between the two countries’ GDP growth rates is quite high, likely due to already strong ties between large industries such as electronics and automobiles.

In addition to diversification, Thai businesses can enjoy relatively smoother economic growth in Indonesia as well, as the standard deviations of GDP growth in Indonesia and Thailand are 0.9% and 4.5%, respectively.

Businesses that have high exposure to domestic consumption spending should look to Indonesia as well. Thai consumer-driven businesses are already attracted to Indonesia, owing to the country’s possessing a consumer base about four times the size of Thailand’s.

Moreover, the negative correlation between the consumption growth rates of Thailand and Indonesia means that businesses can expect operations in Indonesia to continue to do well when operations in Thailand soften, a very desirable property for diversification. In general, consumer-driven businesses can benefit from diversification if they expand to any Asean countries as consumption correlations are quite low for other countries as well.

In addition to Indonesia, Singapore also offers diversification advantages for businesses with high exposure to domestic investment spending. The correlation between the investment growth rates of Thailand and Singapore is close to zero, meaning that businesses can expect operations in Singapore to be relatively unaffected by Thailand’s business cycle.

However, businesses should take into account the fact that Singapore has a smaller market and relatively more volatile investment spending.

Thai businesses should always include diversification in a list of factors to consider when investing abroad. From a macroeconomic point of view, Asean countries, especially Indonesia, offer diversification benefits, notwithstanding already strong trade ties with Thailand.

Given that policymakers are encouraging more outward investment, capable Thai companies should take the opportunity to strategically explore Asean destinations to lower their country-specific business risks.

From: http://www.bangkokpost.com/business/news/343375/do-asean-countries-offer-benefits-of-diversification-to-thai-businesses