Noble borrows ADB’s rating to borrow Thai baht

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://blogs.ft.com/beyond-brics/2013/04/24/noble-borrows-adbs-rating-to-borrow-thai-baht/#ixzz2RR3I13Mt

When is a BBB- borrower actually a AA+? No, this isn’t financial trickery of the kind made famous in the US subprime fiasco (and perhaps repeated in China in 2012). It’s a new facility offered by the Asian Development Bank to promote cross-border borrowing within Asia.

Under the scheme, the ADB-backed fund guarantees the debt of a corporate issuer, and effectively lends out its rating, regardless of the company’s actual rating. It’s been a year in the making, but finally the scheme has broken the seal.

Noble Group – the Hong Kong-based commodities business – this week raised $100m in Thai baht, thanks to the credit guarantee. The 3-year bonds pay a coupon of 3.55 per cent, or around 69 basis points over Thai government bonds of the same duration.

Although Noble is rated BBB-, it was able to use the AA+ rating given by S&P to the ADB-backed Credit Guarantee and Investment Facility (CGIF) for the issue, and had an effective AAA rating within Thailand (the CGIF being seen as a similar credit to the Thai government itself). CGIF is owned by the Asean +3 governments and the ADB.

Should Noble be unable to meet its payments, the creditors can go straight to the CGIF to get their money back.

The ADB has been trying to get the scheme up and running for a while. Now that the first deal is in the market, more such issues are expected to follow.

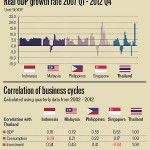

The idea behind it all is to get cross-border lending going, and to encourage more companies to look to regional investors, and to use regional currencies, rather than borrow US dollars from potentially fickle global funds. The bank has been warning recently of the risks of relying too much of foreign capital to fund the region’s massive credit boom. Some governments – like the Philippines – have taken note.

At one $100m deal, it is of course a drop in the rapidly expanding ocean of Asian debt. And the order book for the issue – at under twice the deal size – hardly points to a large untapped source of demand.

But it’s still a milestone, and a real-life example of how Asia might gradually insulate itself a bit more from the whims of Wall Street.

From : http://blogs.ft.com/beyond-brics/2013/04/24/noble-borrows-adbs-rating-to-borrow-thai-baht/#axzz2RR2zDUV3